The specific nature of the “self-employment wage portage” status means that the management of professional expenses is equally special. This guide explains the specifics of business expenses in self-employment wage portage and how to optimize their management.

So follow the guide!

What is a professional fee for self-employment wage portage?

A business expense or expense claim defines the expenses incurred by a contractor in the course of his or her professional activity. Because of the triangular relationship between the contractor, the umbrella company and the client, these expenses are reimbursed either by the client or by the umbrella company.

Business expenses are not taken into account for social security or tax purposes.

Types of fees for self-employment wage portage

Like an employee, a contractor can be reimbursed for professional expenses. Unlike an employee, who is reimbursed by his or her company, a contractor can be reimbursed either by the customer or by the umbrella company. The difference will be in the context of expenditure.

In self-employment wage portage, there are two types of fees:

- Mission expenses.

- Operating costs.

Mission expenses

As the name suggests, these costs are linked to the employee’s assignment. They are charged to the customer. That’s why they’re also called “billable costs”.

Unlike operating costs, which we’ll look at in the second section, there is no upper limit.

Operating expenses

Operating expenses correspond to the costs incurred by the contractor in developing his or her business. They cannot be recharged to the customer.

These expenses are reimbursed by the umbrella company on presentation of receipts. Specific conditions may apply to the reimbursement of these expenses, which are specific to each umbrella company.

Nevertheless, regulations stipulate that operating costs must not exceed 30% of sales excluding VAT.

What expenses can be claimed as business expenses under wage portage?

As we saw earlier, there are two types of expenses: mission expenses and operating expenses. So we’ll break down the costs by type.

Mission expenses

Conditions must be negotiated with the customer at the time of the commercial contract and must be in writing.

To ensure that expenses are not included in social security and tax charges, they must be clearly identified on the invoice, or even be the subject of a specific invoice. Here are some examples of costs that can be covered by the customer:

- Travel expenses

- Accommodation costs

- Material costs related to the mission

- Meal expenses

The components of this list will depend on your negotiations. However, there are still expenses that cannot be billed to the customer, known as “operating costs”.

Operating expenses

- Kilometric expenses: Reimbursement of these expenses is based on a scale that takes into account the tax rating of the vehicle, the type of vehicle (car, motorcycle, etc.) and the number of kilometers traveled.

- Transport costs: this also includes the cost of public transport (metro, bus, train, etc.) or public services such as bicycle hire.

- Supplies: purchase of stationery, envelopes, ink, etc.

- Meal expenses: Inviting a client, for example.

- Telephone charges.

- Connection fees.

- Equipment costs (under 500 euros): over 500 euros, some portage companies count equipment as a fixed asset.

This list is not exhaustive, but gives you an idea of the costs that can be taken into account by the umbrella company.

However, not all umbrella companies operate in the same way. You therefore need to find out how it manages business expenses.

Managing fixed assets

As mentioned above, equipment costing more than 500 euros cannot be claimed as a business expense. However, some umbrella companies allow you to deduct these costs as a capital asset.

These costs generally relate to computers, printers, telephones, etc. The duration of the asset will depend on the useful life of the equipment concerned.

Expense claim procedures

Mandatory information

When producing the expense report, certain items must be included:

- Issuer name.

- Date.

- Nature of costs.

- Description.

- Total amount.

- Means of payment.

Depending on the type of expense, other elements need to be integrated.

Invitation to the restaurant

- Guest name.

- The reason for the invitation.

Mileage expenses

- Reason for travel.

- Travel location.

- Number of kilometers travelled.

- The vehicle’s tax rating.

What should I do if I lose my receipt?

It may happen that the employee loses the receipt. There are 3 possible solutions:

- Request a duplicate from the supplier concerned.

- Justify with a bank statement.

- Make a sworn declaration.

Fraudulent expense claims

False invoices

Hotel, restaurant, airplane or train bills: false invoice fraud involves inflating prices to conceal expenses not related to business activity.

Invite a friend to lunch and charge the ticket as an invitation to a business meal, for example.

Another example: a higher cab fare.

Expense claims from abroad

The language makes it difficult to understand some foreign documents. For example, Japanese. In this case, some contractors can use this to inflate prices and include costs not related to the company.

Currencies

The exchange rate is also an opening for higher repayments. Without a conversion rule, the ported employee can earn on the exchange rate.

Mileage costs

Higher mileage declaration, for example, or using a car with a lower tax rating than that declared.

Duplicates

Use the same receipt to be reimbursed twice.

Expense claims on unpaid invoices

For example, the contractor declares an expense claim for an invitation to a restaurant, even though he was invited.

Business gifts

Give people gifts paid for by the company that are normally intended for business partners.

How can I prevent expense fraud?

To prevent expense fraud, the portage company must control business expenses with :

- Compliance with regulatory ceilings, in particular by ensuring that they are properly applied.

- Receipts for expenses which must accompany claims for reimbursement, as well as compulsory information.

- Expense claim software to help you manage this time-consuming task.

VAT and expense accounts in freelance administration

The umbrella company can recover the tax and reimburse it to the employee’s account.

Conditions for reclaiming VAT

- The invoice must be made out in the portage company’s name.

- VAT must appear on the supporting document, such as an invoice.

- Respect the deadline, i.e. the month in which the purchase is paid for.

- The purchase must be used for business purposes and not more than 90% for private use.

Ineligible purchases

- Housing for managers and employees is not eligible, with the exception of free housing for security, guard and surveillance personnel.

- Transport vehicles included in the company’s assets (transport companies, driving schools, etc. are excluded).

- Business gifts (with the exception of those of very low value).

- Some petroleum products.

- Services related to non-eligible goods.

How can you optimize the management of your expense accounts on wage portage?

To optimize the management of your expense reports, you need to implement two elements:

- A professional spending policy.

- And expense management software.

Professional spending policy

This will enable you to control your employees’ expenses to prevent abuse and fraud. It also saves the company money.

You can, for example, set up a workflow-based validation system, set ceilings on types of expenditure, etc.

Expense management software

Implementing an expense claim management software package will enable you to automate the various stages of the expense claim process, and also :

- Reduce manual data entry, and therefore data entry errors.

- Enhance the employee experience through technologies that facilitate the often time-consuming and non-value-added daily tasks.

- More assiduous monitoring of business expenses.

- Time-saving for both employee and manager.

VSP: software to manage your expense reports

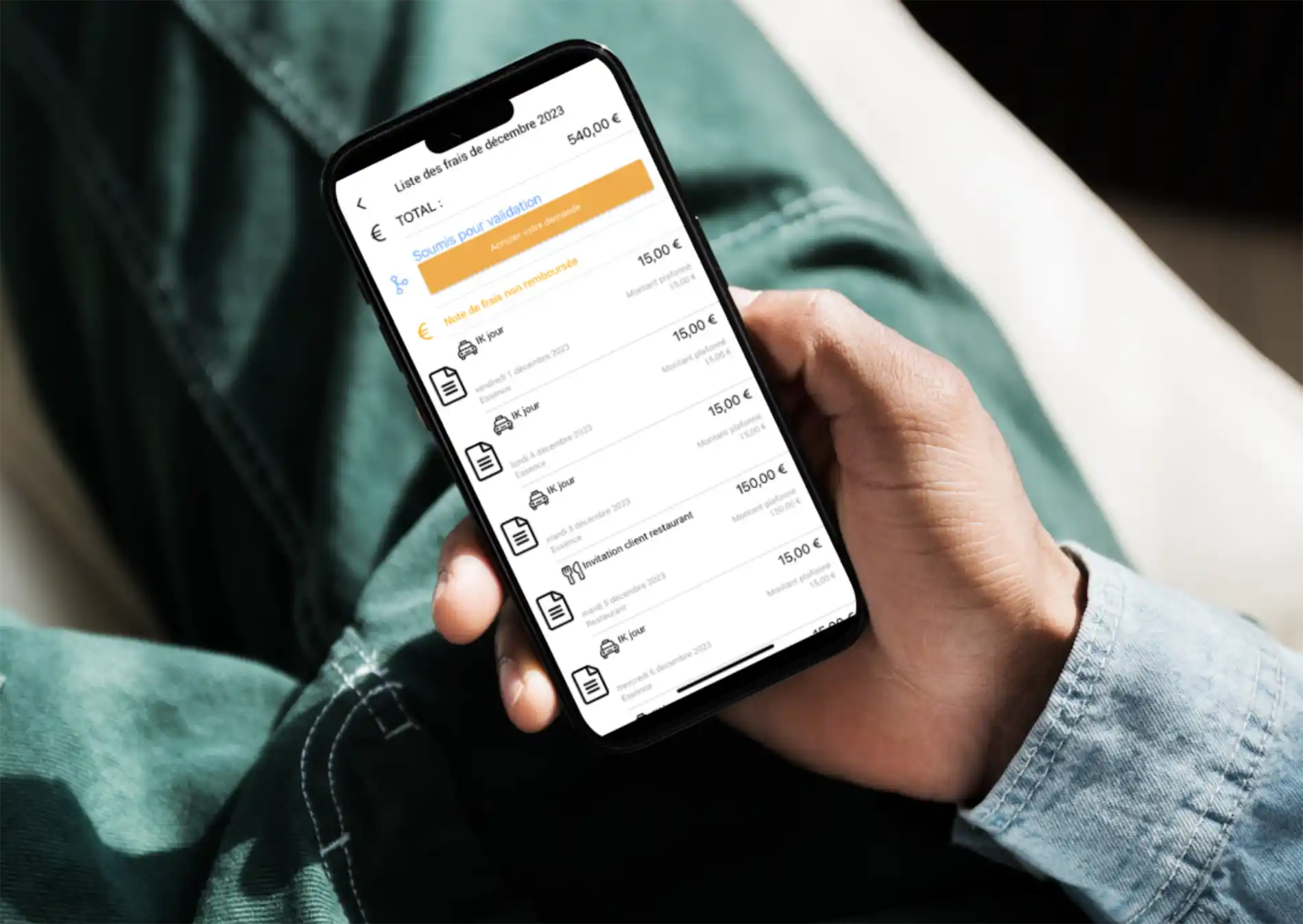

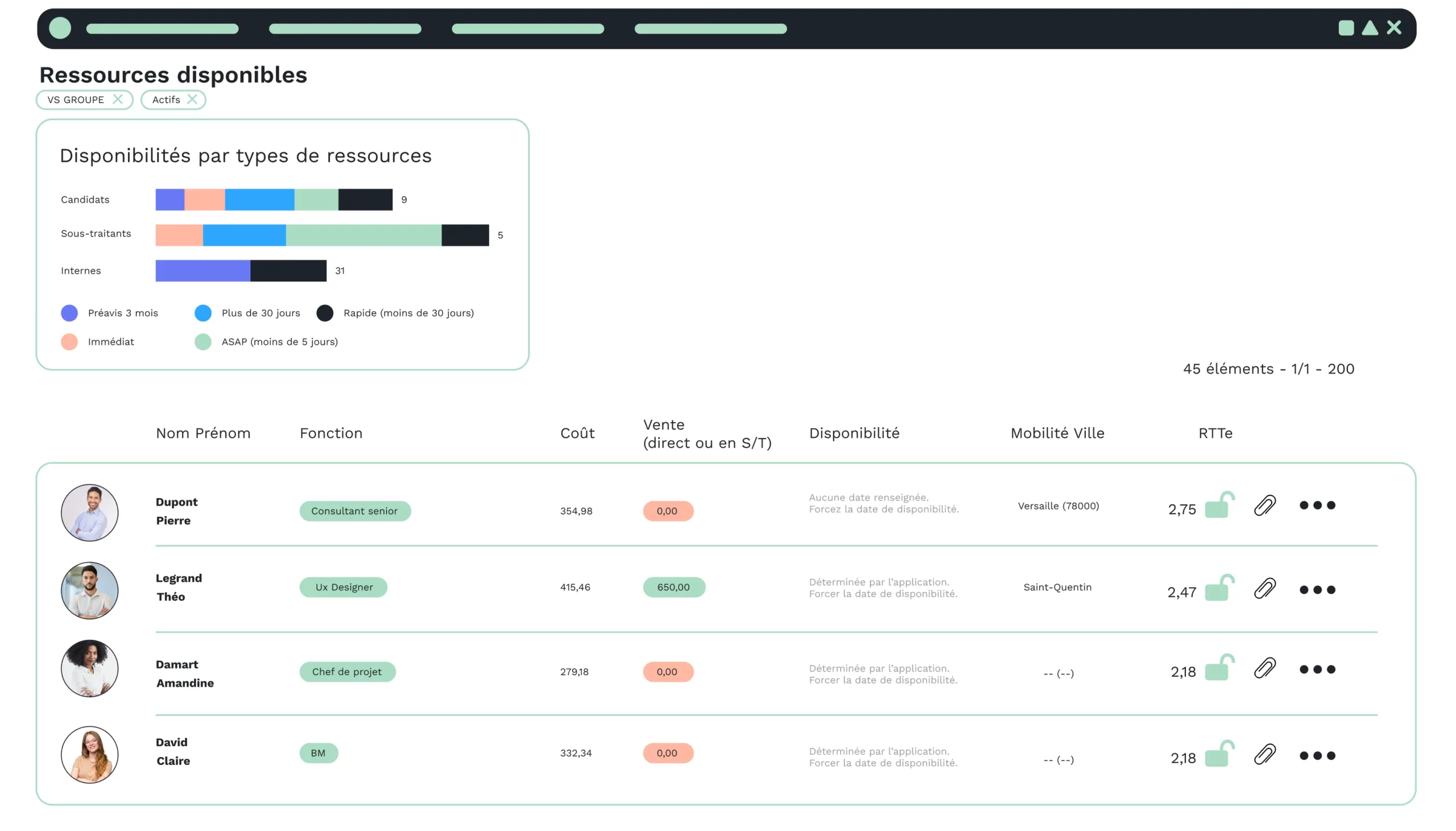

VSP is a dedicated ERP for portage companies. Its expense report module enables both the umbrella company and its employees to optimize the management of this repetitive task. Through several features:

- You can set fee types and set ceilings for each type of fee.

- Declare expenses.

- Manage refunds.

- Make advances on expenses.

- And much, much more.

The software features a mobile application that enables your employees and teams to manage their expense reports on the move.

Read also