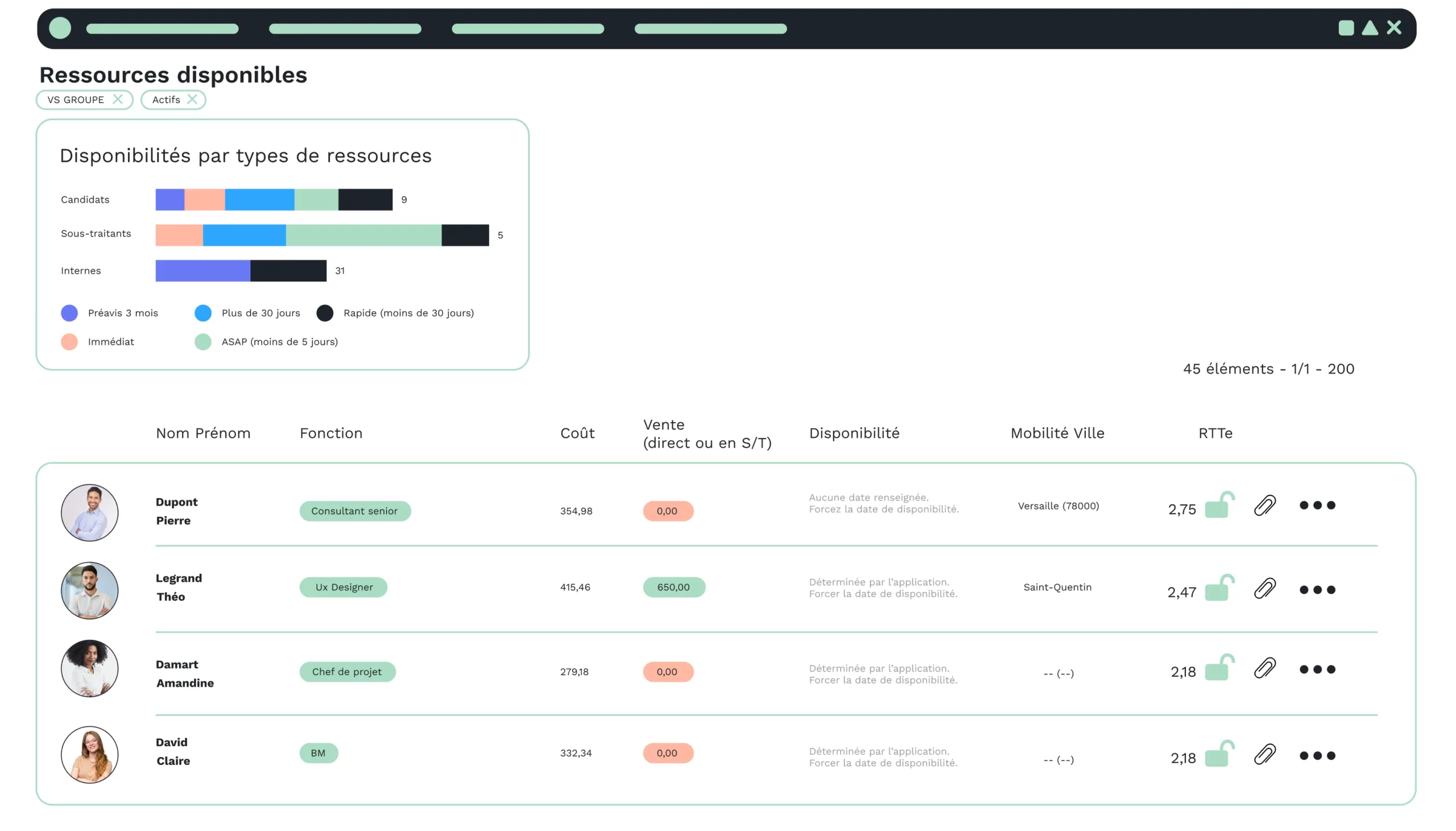

Context

Electronic invoicing, which was due to become compulsory from July 1, 2024, has been postponed significantly…

On July 28, 2023 the DGFIP announced the postponement of the e-invoicing reform, and the 2024 Finance Bill (October 3, 2023) announced a new timetable.

On October 17, 2023, amendment no. I-5395 published the new deployment schedule.

This new obligation will apply to all companies, according to a progressive timetable, and will apply to exchanges between professionals.

By collecting all company invoicing data, the French government hopes to make it easier to steer the country’s economic activity (optimize competitiveness, step up the fight against VAT fraud, etc.).

What is an electronic invoice?

An electronic invoice is a document that attests to the existence and content of a commercial transaction between a supplier and its customer.

It is created, transmitted and received in electronic form.

The General Tax Code defines electronic invoices as :

“An invoice issued, transmitted or received in dematerialized form and which necessarily includes a minimum base of structured data”.

It differs from a simple dematerialized invoice.

- The electronic invoice contains a computer file encrypted in a specific format and containing structured data (e.g. Factur-X).

- Whereas a simple dematerialized invoice is not standardized (a simple PDF file, for example).

Electronic invoicing: nothing new for the public sector

Electronic invoicing has already been in use for several years by all companies providing a service to the State, a local authority or any other public institution.

In fact, the supplier company is obliged to send him an invoice in electronic format.

This obligation applies to all companies, including micro-businesses.

Invoices are sent via a platform set up by the French government, Chorus Pro.

Who is affected by the widespread use of electronic invoicing?

All companies based in France are concerned.

3 conditions

- The company carries out BtoB transactions with other companies. For the moment, B-to-C transactions with private individuals are not (yet) affected by the law.

- The operation is carried out in France.

- The company is subject to VAT.

2 bonds

- The e-invoicing obligation: Companies will have to issue, transmit and receive invoices in electronic form for transactions between taxable persons.

- The obligation to transmit invoice data (e-reporting): This applies to all commercial transactions not covered by e-invoicing. This involves transmitting international B2B and B2C transaction data, as well as data relating to the payment of services, to the tax authorities.

Non-VAT companies established in France

They will not be obliged to issue invoices in electronic format, but must be able to receive them from their suppliers.

Progressive implementation schedule according to the size of your company

Originally scheduled for 2023, the first deadline for electronic invoicing has already been pushed back by more than a year…

And sinceamendment N°I-5395 of October 17, 2023, a further 2-year delay has been buried.

Old calendar

For the record, here is the provisional timetable up to the end of September 2023.

July 1, 2024 (obsolete)

- By July 1, 2024, all businesses will have to accept electronic invoices.

- At the same date, large companies will also be required to issue their invoices in electronic format.

- This concerns around 300 French companies.

- The tax authorities plan to devote the first half of 2024 to a phase of testing flows before the first deadline of July 1, 2024, which concerns Large Corporations.

January 1, 2025 (obsolete)

- Intermediate-sized companies (ETI) will be obliged to issue their invoices in electronic format.

- This represents some 8,000 companies.

January 1, 2026 (obsolete)

- At the beginning of 2026, VSEs (3.5 million companies) and SMEs (150,000 companies) will be obliged to issue their invoices in electronic format.

New calendar

The evolution of the centralizing public portal has been delayed… the new macro-timetable announced at the end of the presentation of the 2024 Finance Bill, on October 3, 2023, and ratified by amendment n°I-5395 of October 17, 2023 is as follows:

- End 2024: delivery of the public billing portal,

- Early 2025: qualification and testing,

- 2025: pilot phase of the public billing portal,

- September 1, 2026: deployment for large companies and ETIs,

- September 1, 2027: roll-out for SMEs and micro-businesses.

Extract from the amendment:

“… The system will be rolled out in two stages: the obligation to issue electronic invoices will start on September 1, 2026 for large and medium-sized companies, and on September 1, 2027 for small and medium-sized companies and micro-businesses. In both cases, given what is at stake for businesses, the implementation dates may be adjusted by one quarter, to ensure reliable deployment. Implementation of transaction data transmission will follow the same timetable.

In brief

So there’s a 2-year gap in relation to the progressive timetable that everyone had in mind.

Large companies and ETIs will have to start issuing from September 2026, rather than July 1, 2024.

Then the other company sizes from September 2027.

One quarter’s flexibility is possible.

e-invoicing

When your company, relative to its size, reaches the deadline for issuing invoices in electronic format, your invoicing process will have to allow for this.

Companies have two options:

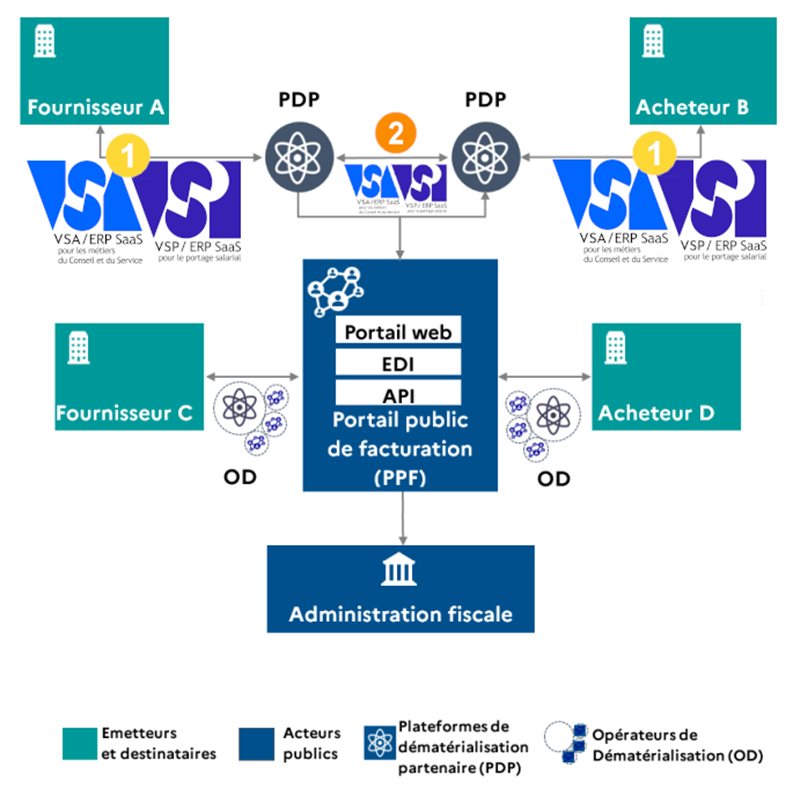

PDP

Use a dematerialization platform partnered with the tax authorities(PDP). Such a platform must therefore be approved by the tax authorities. A PDP converts the PDF invoice into a legally compliant format.

You can already have a software solution that will be PDP-certified in the coming months or years, and still meet your deadline.

PPF

Use the Chorus Pro (PPF) billing portal, currently used for exchanges with the French government and local authorities.

You are about to submit your batches of invoices to Chorus Pro.

This will be possible even without a PDP.

The advantage of a PDP is that it simplifies the workflow (fewer actions are required to invoice).

Y-shaped flow diagram (source: impots.gouv.fr)

VERYSWING: VSA and VSP ready to go

VERYSWING is already actively working on 2 AXES in order to :

- enable direct issue of customer invoices/credit notes in electronic format as expected from VSA / VSP software.

See Phase (1) in the diagram below.

Note that our software already handles :

-

- send customer invoices/credentials (signed PDFs sent by email) and receive supplier invoices/credentials (via OCR) dematerialized,

- broadcast in UBL format in certain cases.

Our aim is to make the Factur-X format the standard output format for customer invoices/credit notes issued by our VSA/VSP software.

This means that you won’t need to use an external Dematerialization Operator (DO) (see Y diagram).

This issue will be technically and functionally addressed and integrated into our software by the end of 2023.

- be PDP :

See Phase (2) in the diagram below.

- Either live

VERYSWING will be applying as a PDP platform. This will enable our VSA and VSP applications to communicate directly with Chorus Pro (PPF) and thus process the entire flow.

It should be noted that the application for PDP certification requires highly advanced security features, including ISO 27001 certification: this is already the case at VERYSWING, which has been ISO 27001-certified since Q4/2022 for all its business processes and SaaS application solutions (VSA, VSP and VSE).

Our application will be submitted in 2024.

- [Si notre candidature traîne trop à être traitée par l’administration fiscale] get in touch with one or more partners (who, before us, would be certified as PDP platforms).

With this plan B, we’ll be able to integrate their PDP at the output of our software to cover the complete flow to the PPF… until we become PDP ourselves.

Y-shaped flow diagram integrating VSA/VSP

e-reporting

Companies subject to mandatory electronic invoicing will also be required to transmit to the tax authorities certain invoicing data relating to business transactions not covered by mandatory electronic invoicing, i.e. :

- sales and service transactions with private individuals,

- transactions with foreign-based operators,

- payment data relating to the sale of services.

Please note: VAT-exempt operations do not fall within the scope of e-reporting.

This applies in particular to certain banking and insurance operations, medical and health services, educational services and operations carried out by non-profit organizations.

The introduction of thise-reporting obligationis timed to coincide with the roll-out of mandatoryelectronic invoicing.

E-reporting transaction data must be sent by the company using the same transmission channel as electronic invoicing, i.e. via the Public Billing Portal or via a Partner Dematerialization Platform authorized by the Administration.

VERYSWING will be addressing this issue through the actions mentioned above in the e-invoicing section.

APPENDICES

APPENDIX 1: Possible formats for electronic invoices

To be an electronic invoice, an invoice in France must be in one of the following three formats:

UBL (Universal Business Language)

This is an XML-based electronic invoice format, which provides a standard data model for electronic invoicing.

UBL was developed by the Organization for the Advancement of Structured Information Standards (OASIS) and is maintained by the OASIS Technical Committee on UBL.

CII (Cross Industry Invoice)

Inter-Industry Invoice is a technical specification used to create the message syntax that can be exchanged worldwide between trading partners.

CII was developed by the United Nations Centre for Trade Facilitation and Electronic Business (UN/CEFACT).

Factur-X

Factur-X is a format that contains both a user-readable PDF file and its attached data in XML, and is the most widely used format for being inexpensive compared with processes such as tax EDI.

Factur-X was developed jointly by the French tax authorities (DGFiP), the Union Interdépartementale pour la Facturation Electronique (UIEE) and experts from various industries in France.