Context

Electronic invoicing will be mandatory from July 1, 2024.

This new obligation concerns all companies, according to a progressive timetable, and applies to exchanges between professionals.

By collecting all company invoicing data, the French government aims to make it easier to steer the country’s economic activity (optimize competitiveness, step up the fight against VAT fraud, etc.).

What is an electronic invoice?

An electronic invoice is a document that attests to the existence and content of a commercial transaction between a supplier and its customer.

It is created, transmitted and received in electronic form.

The General Tax Code defines electronic invoices as :

| “An invoice issued, transmitted or received in dematerialized form and which necessarily includes a minimum base of structured data”. |

It differs from a simple dematerialized invoice.

- The electronic invoice contains a computer file encrypted in a specific format and containing structured data (e.g. Factur-X).

- Whereas a simple dematerialized invoice is not standardized (a simple PDF file, for example).

Electronic invoicing: nothing new for the public sector

Electronic invoicing has already been in use for several years by all companies providing a service to the State, a local authority or any other public institution.

In fact, the supplier company is obliged to send him an invoice in electronic format.

This obligation applies to all companies, including micro-businesses.

Invoices are sent via a platform set up by the French government, Chorus Pro.

Who is affected by the widespread use of electronic invoicing?

All companies based in France are concerned.

3 conditions

- The company carries out BtoB transactions with other companies. For the moment, B-to-C transactions with private individuals are not (yet) affected by the law.

- The operation is carried out in France.

- The company is subject to VAT.

2 bonds

- The e-invoicing obligation: Companies will have to issue, transmit and receive invoices in electronic form for transactions between taxable persons.

- The obligation to transmit invoice data (e-reporting): This applies to all commercial transactions not covered by e-invoicing. This involves transmitting international B2B and B2C transaction data, as well as data relating to the payment of services, to the tax authorities.

Non-VAT companies established in France

They will not be obliged to issue invoices in electronic format, but must be able to receive them from their suppliers.

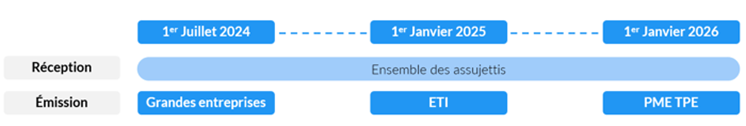

Progressive implementation schedule according to the size of your company

Originally scheduled for 2023, the first deadline for electronic invoicing has already been pushed back by more than a year…

July 1, 2024

- By July 1, 2024, all businesses will have to accept electronic invoices.

- At the same date, large companies will also be required to issue their invoices in electronic format.

- This concerns around 300 French companies.

- The tax authorities plan to devote the first half of 2024 to a phase of testing flows before the first deadline of July 1, 2024, which concerns Large Corporations.

January 1, 2025

- Intermediate-sized companies (ETI) will be obliged to issue their invoices in electronic format.

- This represents some 8,000 companies.

January 1, 2026

- At the beginning of 2026, VSEs (3.5 million companies) and SMEs (150,000 companies) will be obliged to issue their invoices in electronic format.

In brief

Issuing paper and PDF invoices will continue to be the norm for many organizations until 2026.

From July 1, 2024, only large companies will be required to issue electronic invoices.

ETIs will be able to continue issuing paper or PDF invoices via email until 2025, and small businesses until 2026.

e-invoicing

When your company, relative to its size, reaches the deadline for issuing invoices in electronic format, your invoicing process will have to allow for this.

Companies have two options:

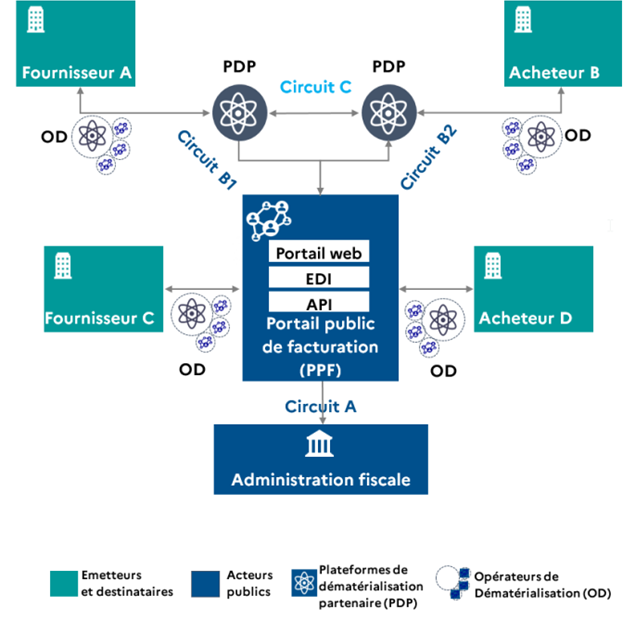

PDP

Use a dematerialization platform partnered with the tax authorities(PDP). Such a platform must therefore be approved by the tax authorities. A PDP converts the PDF invoice into a legally compliant format.

You can already have a software solution that will be PDP-certified in the coming months or years, and still meet your deadline.

PPF

Use the Chorus Pro (PPF) billing portal, currently used for exchanges with the French government and local authorities.

You are about to submit your batches of invoices to Chorus Pro.

This will be possible even without a PDP.

The advantage of a PDP is that it simplifies the workflow (fewer actions are required to invoice).

Y-shaped flow diagram (source: impots.gouv.fr)

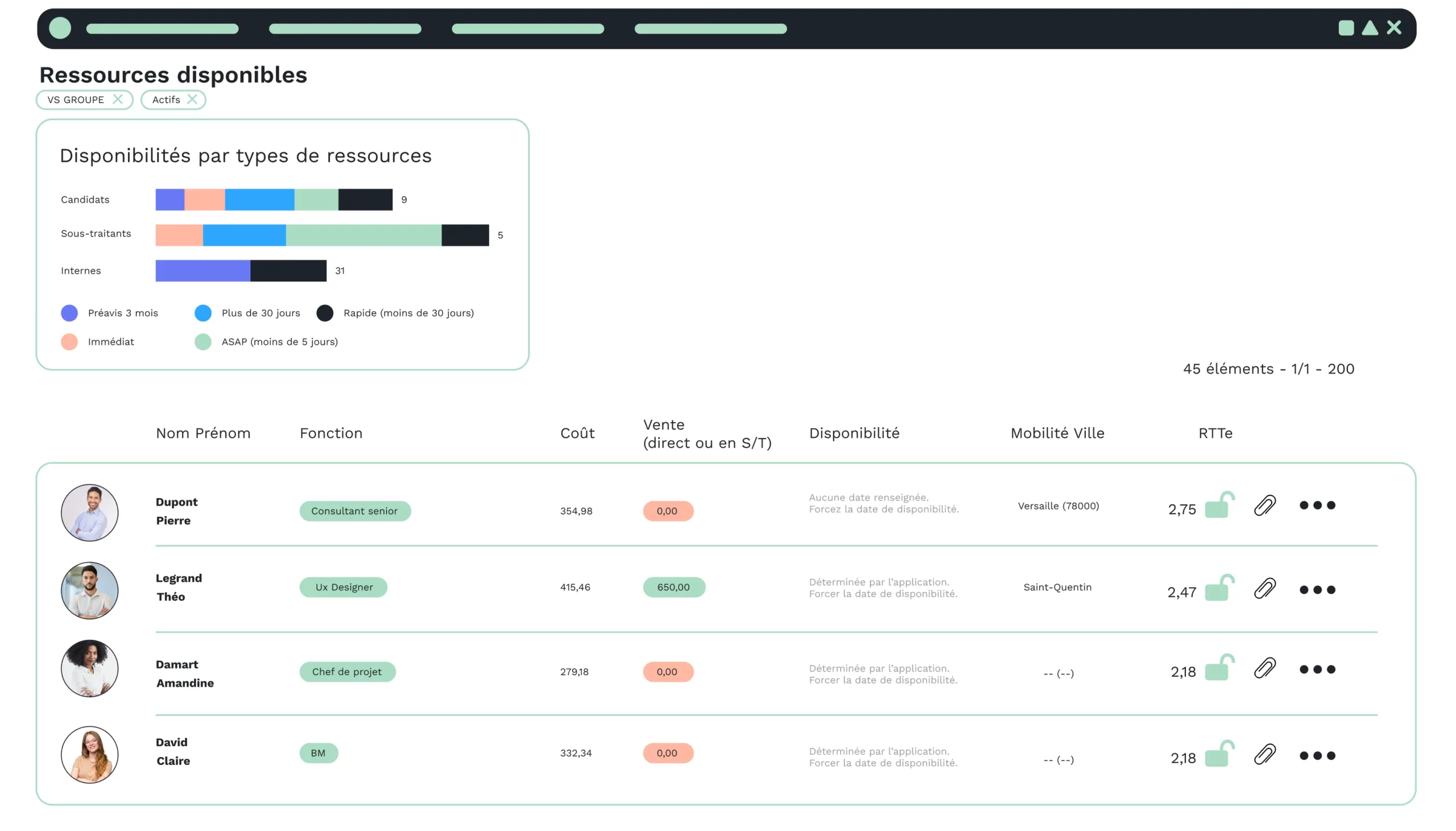

VERYSWING: VSA and VSP ready to go

VERYSWING is already actively working on 2 AXES in order to :

- enable direct issue of customer invoices/credit notes in electronic format as expected from VSA / VSP software.

See Phase (1) in the diagram below.

Note that our software already handles :

-

- send customer invoices/credentials (signed PDFs sent by email) and receive supplier invoices/credentials (via OCR) dematerialized,

- broadcast in UBL format in certain cases.

Our aim is to make the Factur-X format the standard output format for customer invoices/credit notes issued by our VSA/VSP software.

This means that you won’t need to use an external Dematerialization Operator (DO) (see Y diagram).

This issue will be technically and functionally addressed and integrated into our software by the end of 2023.

- be PDP :

See Phase (2) in the diagram below.

- Either live

VERYSWING will be applying as a PDP platform. This will enable our VSA and VSP applications to communicate directly with Chorus Pro (PPF) and thus process the entire flow.

It should be noted that the application for PDP certification requires highly advanced security features, including ISO 27001 certification: this is already the case at VERYSWING, which has been ISO 27001-certified since Q4/2022 for all its business processes and SaaS application solutions (VSA, VSP and VSE).

Our application will be submitted before the end of Q4/2023.

- [Si notre candidature traîne trop à être traitée par l’administration fiscale] get in touch with one or more partners (who, before us, would be certified as PDP platforms).

With this plan B, we’ll be able to integrate their PDP at the output of our software to cover the complete flow to the PPF… until we become PDP ourselves.

Y-shaped flow diagram integrating VSA/VSP

e-reporting

Companies subject to mandatory electronic invoicing will also be required to transmit to the tax authorities certain invoicing data relating to business transactions not covered by mandatory electronic invoicing, i.e. :

- sales and service transactions with private individuals,

- transactions with foreign-based operators,

- payment data relating to the sale of services.

Please note: VAT-exempt operations do not fall within the scope of e-reporting.

This applies in particular to certain banking and insurance operations, medical and health services, educational services and operations carried out by non-profit organizations.

The introduction of thise-reporting obligationis timed to coincide with the roll-out of mandatoryelectronic invoicing.

E-reporting transaction data must be sent by the company using the same transmission channel as electronic invoicing, i.e. via the Public Billing Portal or via a Partner Dematerialization Platform authorized by the Administration.

VERYSWING will be addressing this issue through the actions mentioned above in the e-invoicing section.

APPENDICES

APPENDIX 1: Possible formats for electronic invoices

To be an electronic invoice, an invoice in France must be in one of the following three formats:

UBL (Universal Business Language)

This is an XML-based electronic invoice format, which provides a standard data model for electronic invoicing.

UBL was developed by the Organization for the Advancement of Structured Information Standards (OASIS) and is maintained by the OASIS Technical Committee on UBL.

CII (Cross Industry Invoice)

Inter-Industry Invoice is a technical specification used to create the message syntax that can be exchanged worldwide between trading partners.

CII was developed by the United Nations Centre for Trade Facilitation and Electronic Business (UN/CEFACT).

Factur-X

Factur-X is a format that contains both a user-readable PDF file and its attached data in XML, and is the most widely used format for being inexpensive compared with processes such as tax EDI.

Factur-X was developed jointly by the French tax authorities (DGFiP), the Union Interdépartementale pour la Facturation Electronique (UIEE) and experts from various industries in France.