One of the advantages of wage portage for an independent contractor is that the administrative and social aspects are managed by the umbrella company. By administrative and social management we mean: contracts, invoicing, remuneration, accounting, etc.

In exchange for this management, the employee pays back a portion of the sales he generates through a “management fee”. These fees may vary from company to company. This is one of the criteria for selecting a umbrella company.

How are management fees calculated? And what impact does this have on the employee’s salary? Some answers.

What are the terms and conditions for working for an umbrella company?

When you are interested in an umbrella company, it is essential to read carefully what the service covers. In fact, management fees are one of the criteria that will determine your take-home pay.

As we said earlier, management fees are payable in exchange for a service provided by the umbrella company.

This service includes :

- Drawing up the contract between the company and the ported employee

- Drawing up the commercial contract between the contractor and his customer

- Administrative procedures for compulsory contributions (sickness, old age, family allowance, training, supplementary pension and provident fund)

- Single declaration of employment to URSSAF (DUE)

- Invoicing clients and managing overdue payments

- Production of the employee’s pay slip

- The possible presence of a works council

- Tools for managing the activity of the contractor

Companies can offer additional services that are included in the management fee. To find out about all the services included in the package, you can visit the company’s website or contact them.

In any case, companies usually advertise their management rate on their website, but this may conceal additional charges.

How are management fees calculated?

Management fees can vary between 5% and 15% of sales excluding tax, but it is important to take into account any additional charges that may be levied and that are linked to your business (taxes, sales tax, etc.).

You should contact the umbrella companies you are interested in and ask them for a simulation to get a precise idea of your net remuneration.

It’s by comparing the different feedback you get from companies that you can determine the real impact of management fees on your remuneration. In fact, as mentioned above, additional costs can have an impact.

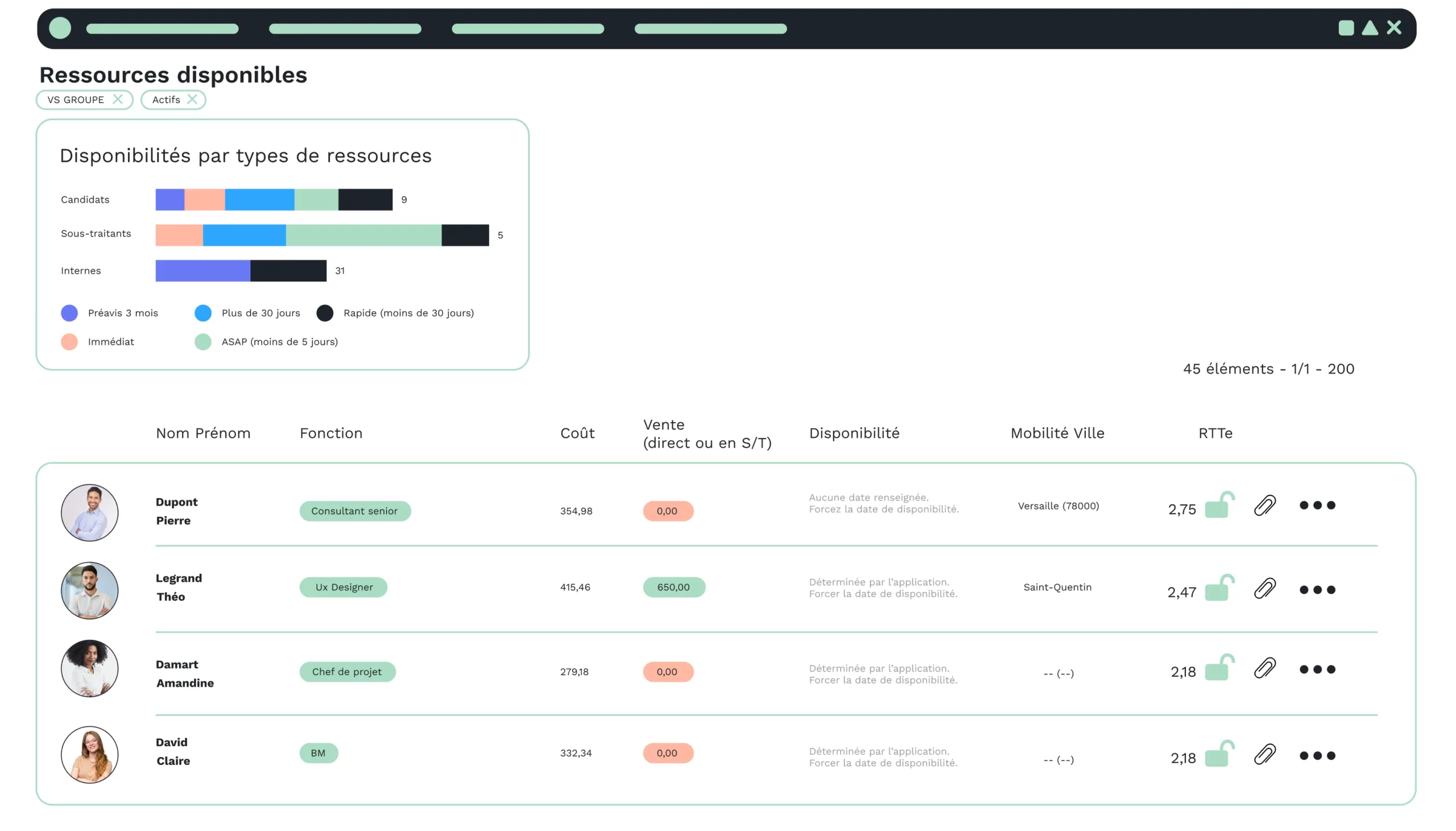

VSP, a business ERP for staffing companies

The umbrella company also offers tools to support contractors.

VSP is an ERP system with a wide range of functions covering the monitoring of the activity of the contractor and the management of the umbrella company. The solution saves time by automating tasks, allowing you to concentrate on those with higher added value.

For both the employee and the company, VSP offers a number of advantages.

For the contractor

With VSP, employees can follow their activity from prospecting to project follow-up with their customers. With the CRM module, you can prospect, call back prospects, create sales proposals/quotations; you can then track projects by customer and analyze the profitability of each deal signed, by project or by customer.

He can, of course, enter his time spent and integrate his business expenses directly into the solution. The user doesn’t need to enter the same information several times, since all the application’s modules are perfectly interwoven.

The reporting and “Pro Account” available to him give him a global and synthetic view of his activity.

For the umbrella company

VSP supports companies in their day-to-day administrative management. Whether it’s recruiting portés, monitoring activities, assignments or projects, managing invoicing, HR and payroll in particular, …

The tool automates and saves time, starting from data already integrated into the software. This eliminates the need to re-enter data transmitted by contractors, and thus avoids copying errors. You no longer have to wait for your employees to return to you before you can issue invoices; in fact, the employee himself pre-validates his own invoice(s).

The tool will set up ported employees’ Pro Accounts, allow you to modify the rules for each ported employee, validate “reverse” pay and export to the software that produces pay slips. In addition, these can be reintegrated into VSP, so that wearers can have them electronically.

You also have cross-functional views of HR activities concerning absences, sick leave, etc.

All in all, VSP offers a full range of functionalities dedicated to umbrella companies. Do you have an implementation project? Would you like to test the benefits of our solution?

We offer a free trial of our solution, or if you prefer, demos are also available.