Yes, a self-employed contractor is entitled to paid leave in the same way as an employee. And this is true regardless of whether you have a permanent or fixed-term contract. There are, however, a few differences in the way paid vacations are calculated for wage portage.

In this article, we explain how paid leave is calculated when you’re a freelance worker, and give you a few tips to make managing your leave easier.

Basic rules for paid vacations in self-employment wage portage

The same rights as an employee…

As a contractor, you are entitled to paid vacations in the same way as an employee. As stipulated in the collective agreement for freelance workers, the freelance consultant is entitled to 2.5 working days for each month of actual work, i.e. 30 days or 5 weeks.

There is also a reference period between June 1 and May 31 of the following year. This leave can be taken as soon as the employee is hired.

Autonomous management

With wage portage, neither the company nor the client can impose vacations on the consultant. He is therefore free to place them whenever he wishes.

The paid leave process in wage portage

Anticipating vacations to suit the mission

Of course, the freelance consultant is free to take vacations whenever he likes, but he must inform both his umbrella company and the customer for whom he is carrying out his assignment.

Contractors therefore need to plan their leave in advance to ensure that their assignment runs smoothly, in agreement with their client.

Repayment of vacation pay

As part of its administrative management role, the umbrella company must pay out the employee’s vacation pay in the form of an indemnité compensatrice de congés payés (ICCP).

Allowances must appear separately on the employee’s payslip.

What is compensation for paid vacation?

The compensation for paid leave is a sum paid by the umbrella company to the contractor each month. It corresponds to the sum of the employee’s paid leave entitlements during the reference period.

This amount is factored into the contractor’s pricing when negotiating with the customer. At the very least, the contractor should be sure to include it in his rates.

There are several methods for calculating vacation pay.

How do you calculate vacation pay for freelance workers?

There are two ways of calculating vacation pay for freelance workers:

- Continued remuneration

- 1/10 of gross salary

The umbrella company must choose the method most favorable to the contractor for calculating his compensation.

Salary continuation

As the name suggests, this method involves maintaining the employee’s salary.

Nevertheless, given the variation in the salaries of a contractor, the 1/10 method is the most popular.

For example:

- Freelance workers take 2 weeks’ leave, i.e. 12 working days

- Each month, he receives €1,850

- According to the salary maintenance rule, the freelancer will receive : (1850/26) * 12 = 854 €

1/10 of gross salary

This method is more advantageous for contractors, who do not receive the same salary month after month. This involves taking 1/10 of the employee’s gross annual salary.

For example:

- Contractors take 2 weeks’ leave, i.e. 12 working days

- During the year, he received :

| Month 1 | 1850€ |

| Month 2 | 2200€ |

| Month 3 | 1600€ |

| Month 4 | 1450€ |

| Month 5 | 1600€ |

| Month 6 | 2200€ |

| Month 7 | 1850€ |

| Month 8 | 2200€ |

| Month 9 | 1450€ |

| Month 10 | 1850€ |

| Month 11 | 1850€ |

| Month 12 | 1850€ |

- His annual remuneration is €21,950

- According to the 1/10th rule, the consultant will receive : (21 950/10) * (12/30) = 878 €

The method that is most favorable to the contractor must be chosen.

Let’s take a comparative example based on the same remuneration:

If we go back to our first case with the employee who received the same salary each month, here’s what it looks like:

- Gross annual salary: €22,200, i.e. €1,850/month.

- Using the “maintenance” method, the employee would receive: €854

- According to the 1/10th rule, the employee would receive: (22,200/10) *(12/30) = €888

The 1/10th calculation is therefore more favorable to the employee, so the staffing company should use this second rule.

Tips for managing paid leave on a freelance basis

Using management software

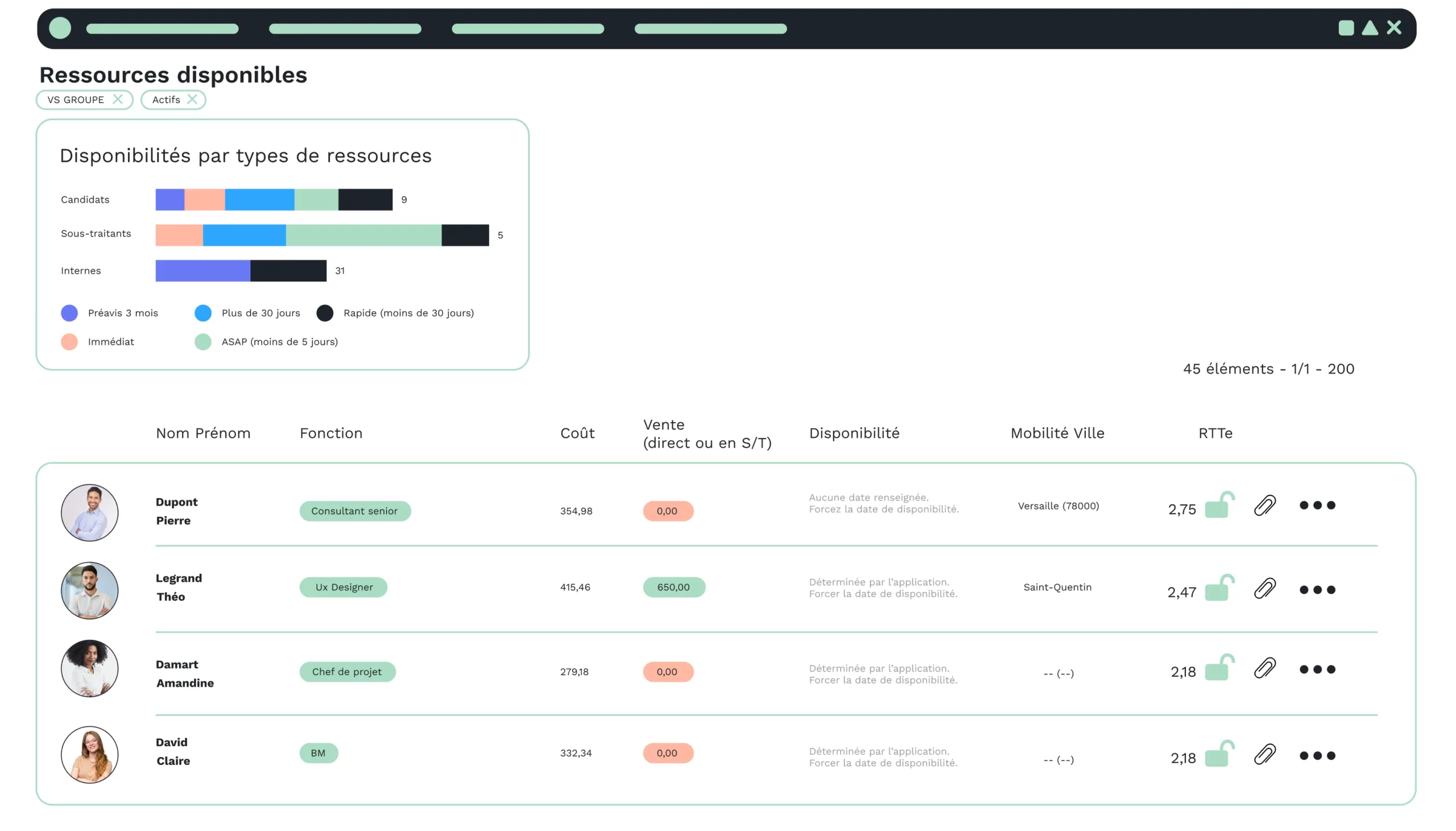

To make it easier for all parties involved to manage paid leave, you can use management software. The latter allows you to automate calculations that can be cumbersome.

For example, the VSPortage (VSP) software package allows you to calculate leave reserves on several bases:

- Amount available.

- Monthly sales.

- Payroll costs.

- The fixed amount is deducted from the available amount.

- The fixed amount deducted from payroll.

You can also specify a reserve percentage and the months and years to be taken into account.

Management software offers a number of advantages for the various stages of the paid leave process in wage portage:

For the consultant

- When negotiating with customers, he may include paid vacations in his rates.

- He can enter his absences and the software will automatically calculate his reserve for the month concerned.

- He can consult his leave reserves at any time.

For the umbrella company

- Calculations of vacation pay are automated. This automation makes it possible to process an increasingly large number of portfolios, saving time and improving reliability.

- The software provides flexibility in the rules to be applied and reliability.

- The umbrella company can offer its associates a modern solution for monitoring their activity: time at the customer’s premises, but also time off.

Conclusion on how to calculate vacation pay for freelance workers

As you can see, wage portage entitles the employee to paid leave. When negotiating with the customer, you need to remember to factor this into your price.

There are two methods for calculating the indemnity: the one chosen by the umbrella company must be the most advantageous for the employee.

Tools such as management software are available to automate this cumbersome and time-consuming calculation process. Such software offers numerous advantages for both the employee and the staffing company, including a global vision and time savings.