Many companies are experiencing cash flow problems, which is impacting their development. They can neither invest nor hire. One of the factors behind this scourge is unpaid bills. Despite legislation, 58.3%* of companies are victims of non-payment. And yet, there are solutions for predicting financial needs and anticipating breakage.

The scourge of late payment

Over the past few months, you’ve no doubt read and reread articles about astronomical fines handed down by the Direction Générale de la Concurrence, de la Consommation et de la Répression des Fraudes (DGCCRF) for late inter-company payments.

On average, payment terms in France are between 45 and 60 days. However, despite legislation, 58.3% of companies are victims of non-payment. This scourge hinders the growth of these companies, which are not only unable to invest and hire, but also have to pay creditors.

What does the law say about payment terms?

According to the French Law on the Modernization of the Economy, payment must be made within 30 days of receipt of goods or services. With the agreement of both parties, this period can be extended to 60 days. A period of 45 days end of month may be agreed by derogation. Deadlines must be legible on the invoice and General Terms and Conditions (GTC).

In the event of non-compliance, penalties of up to €2 million can be imposed, and in the event of a repeat offence, the fine can be doubled (within two years of the date of the first penalty).

Technology for CFOs

Over and above the legal framework, technology has seen the emergence of tools to help CFOs anticipate unpaid invoices and implement a strategy. These tools can perform automatic reminders by e-mail and/or post, monitor outstanding invoices, and perform financial analysis to identify needs and study customer payment behavior.

Based on this information, the CFO takes strategic decisions (such as factoring, for example) to anticipate financial needs, optimize cash flow and thus ensure the company’s long-term viability.

What tools can you use to anticipate your finances?

As you might expect, we’ll be talking about VSA.

The software helps you keep track of your invoices to anticipate unpaid bills.

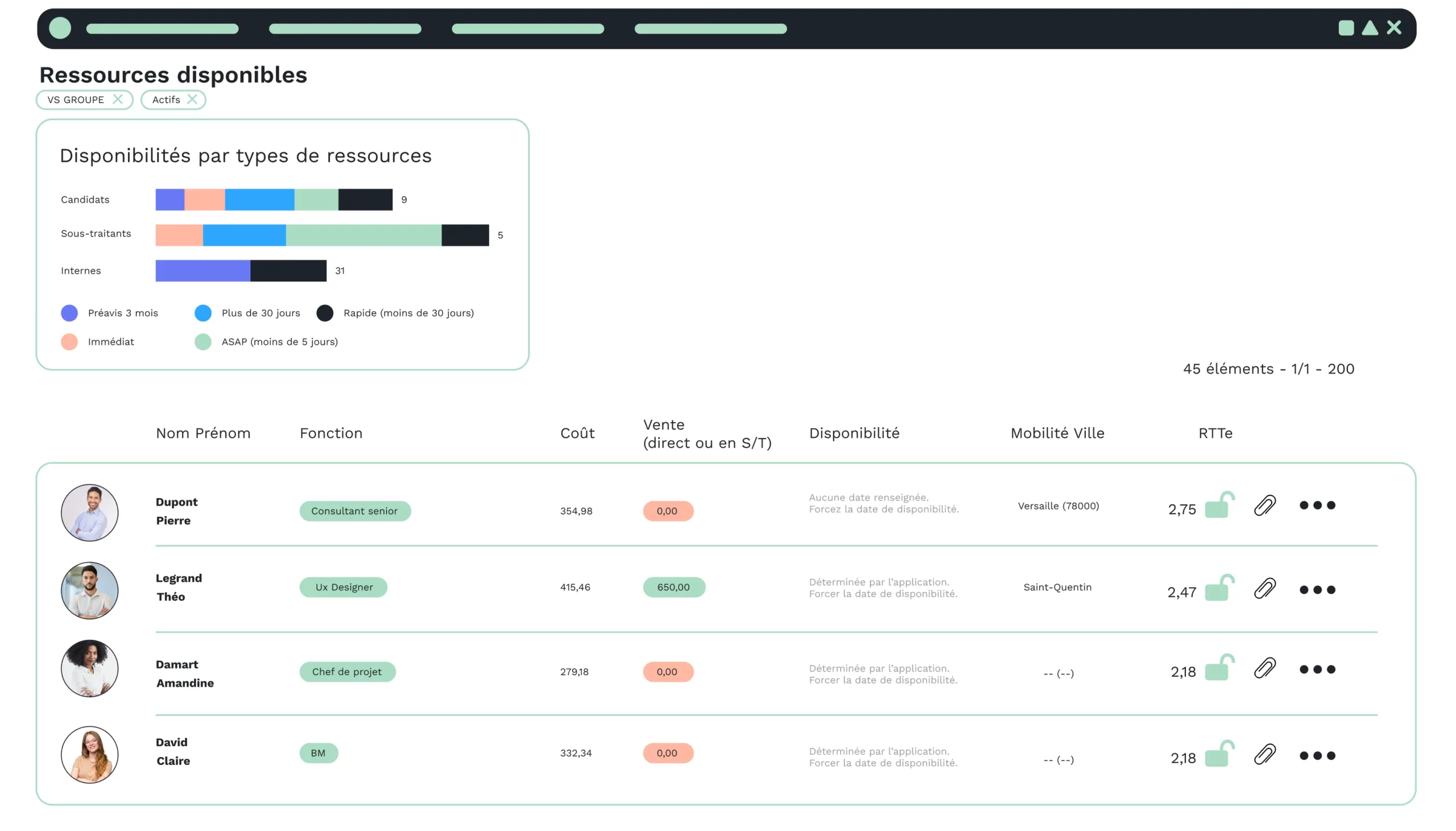

Numerical and graphical indicators (outstanding invoices, lead times, etc.) give you an overview of the status of your invoices. From this information, the software enables you to send out customer reminders via customizable e-mails, telephone scenarios and even standard letters for postal dispatch.

You can track the status of your invoices, and a history is available for each customer. From there, you can carry out an analysis of customers who are regularly in arrears with their payments, and implement an appropriate strategy(factoring , etc.).

To take things even further, VSA gives you a three-month rolling view of your cash position, which is automatically updated according to your financial activities (sales, purchases, etc.). You can therefore monitor your cash flow and optimize your budget for the coming weeks.

The software is packed with features to help you manage your day-to-day finances.

Don’t hesitate to contact us for a free trial or demo.

*Source: Euler study