Self-employment wage portage has not escaped the COVID-19 crisis. Contractors are also facing a drop in business, as the companies they work for are also experiencing a decline in activity, at least for some of them.

According to FEPS (Fédération des Entreprises de Portage Salarial), the French Ministry of Labor has made Self-employment wage portage eligible for short-time working. But what are the conditions? How are they applied? What formalities do umbrella companies and freelancers need to carry out? Here are the 5 questions you may have about short-time working and freelance administration.

What is short-time working?

Also known as “technical unemployment” or “partial activity”, this is a system that enables companies to reduce or interrupt employee activity.

Article R5122-1 of the French Labor Code provides a framework for this system, setting out the valid reasons why a company may resort to short-time working:

- Economic conditions

- Difficulties in sourcing raw materials or energy

- Exceptional damage or bad weather

- Company transformation, restructuring or modernization

- Any other exceptional circumstances

How does short-time working work?

The request for short-time working must be made by the employer, and must comply with the grounds laid down in the French Labor Code.

To set up partial activity, employers must apply online via the following portal: https://activitepartielle.emploi.gouv.fr.

You have 30 days in which to make the request from the moment you put your employees on short-time working. This request can be granted for a period equivalent to 12 months.

In other words, if you apply on April 20, 2020, authorization may be granted until April 20, 2021.

When partial activity is in place, the employer receives an allowance from the Agence de services et de paiement (ASP) representing 70% of the employee’s gross remuneration (around 84% of his net salary).

This allowance is limited to a salary of 4.5 SMIC and a minimum of €8.03 per hour.

To illustrate this, here are 3 examples given by the government:

Example 1:

An employee earns 10.15 euros gross per hour (1 SMIC gross) for a 42-hour week. His company’s activity was completely interrupted for three weeks.

70% of 10.15 is equal to 7.1 euros, which would be the amount of the partial activity allowance. However, this amount is below the floor of 8.03 euros.

As the decree sets the minimum allowance at 8.03 euros, the hourly allowance paid to the employer will be 8.03 euros.

Partial activity takes into account the number of hours not worked, up to a maximum of 35 hours per week. 7 hours a week (42-35=7) will therefore not count towards the allowance if the employee is completely unemployed.

The employer will receive an allowance of : 8.03 x 35 x 3 = 843.15 euros.

The employer must pay the employee an equivalent indemnity. It will not be subject to social security contributions. There will be no out-of-pocket expenses.

Example 2:

An employee earns 30.45 euros gross per hour (3 SMIC gross) for a 20-hour weekly contract. His company’s activity was completely interrupted for a week.

70% of 30.45 is equal to 21.31 euros.

Partial activity takes into account the number of hours not worked, up to a limit of 35 hours per week or the contractual number of hours. 20 hours will therefore be counted towards the allowance.

The employer will receive an allowance of : 21.31 x 20 = 426.2 euros.

The employer must pay the employee an equivalent indemnity, subject to CSG and CRDS (6.7%). There will be no out-of-pocket expenses.

Example 3:

An employee earns 50.75 euros gross per hour (5 SMIC gross) for a 35-hour week. His company’s activity was completely interrupted for two weeks.

70% of 50.75 is equal to 35.52 euros.

The result is over 31.98 euros (representing 70% of 4.5 smic/hour gross).

Partial activity takes into account the number of hours not worked, up to a limit of 35 hours per week or the contractual number of hours. 70 hours will therefore be counted towards the allowance.

The employer will receive an allowance of : 31.98 x 35 x 2 = 2238.6 euros.

The employer must pay the employee compensation of : 35.52 x 35 x 2 = 2,486.4 euros.

This allowance will be subject to CSG and CRDS (6.7%).

The employer will have to pay: 2486.4 – 2238.6 = 247.8 euros.

Who can benefit from short-time working?

All company employees may be affected by partial activity, regardless of their type of contract, seniority or working hours.

The employer must request it, and does not need the employee’s agreement.

-

Short-time working and permanent contract with wage portage with assignment?

Contractors with permanent contracts can benefit from short-time working. This compensation will be paid until the end of the customer’s assignment, as stipulated in the contract.

The employee must provide proof of suspension, cancellation or termination of his or her assignment due to COVID-19, supplied by the customer, to his or her staffing company.

-

Short-time working and fixed-term contract with wage portage?

Temporary agency workers are eligible for short-time working on the same basis as other employees, i.e. 70% of the gross hourly wage (i.e. 84% of the net wage).

The employee must provide the company with proof of suspension, cancellation or termination of the assignment, due to COVID-19.

The government has yet to implement certain aspects of short-time working for freelance workers. In fact, the specific nature of the “portage salarial” status makes it more difficult to set up conditions for access to short-time working, particularly in the case of permanent “portage salarial” contracts with no assignment.

What is the social security system applicable to partial activity benefits?

Partial activity allowances are subject to CSG and CRDS. For non-residents of France for tax purposes, short-time working is subject to a 2.80% health contribution.

Employees affiliated to the compulsory supplementary health insurance schemes of Haut-Rhin, Bas-Rhin and Moselle are liable for the 1.50% health contribution.

Which application should you use to manage short-time working in your umbrella company?

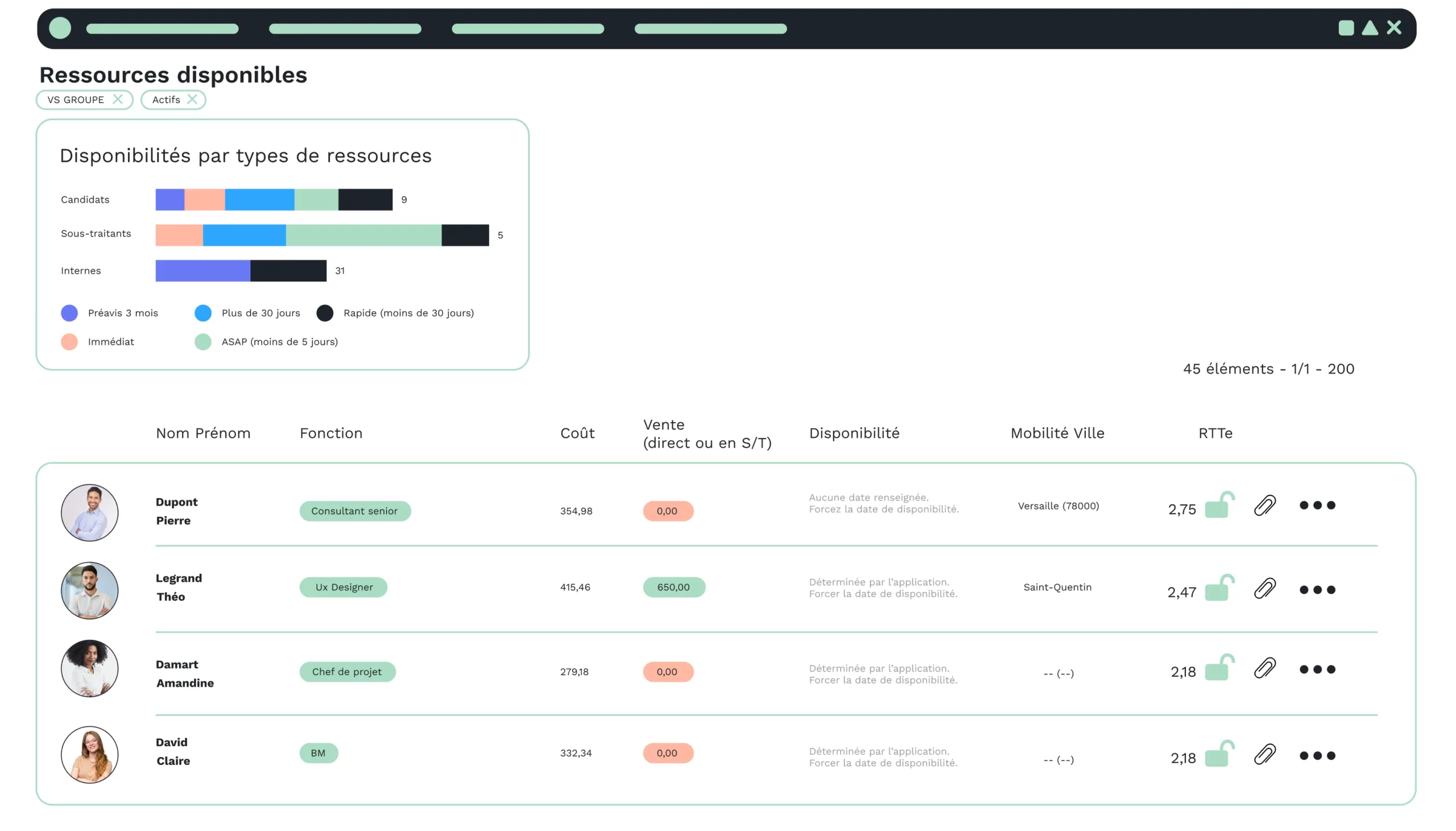

VSP: The application to support your HR management

Excel files, non-interoperable software or the multiplication of software packages have their limits in your human resources management.

VSP lets you automate your processes by adapting them to the unexpected, as is the case today with COVID-19. With the application, you can allocate time for managing short-time working, apply exemption from charges or manage government reimbursements.

Your contractors will be able to integrate customer company receipts into their space. You’ll know where to find the information and won’t have to wait for a mailing or search through your emails.

The application is not limited to management of the COVID-19 crisis, and covers a wide range of HR functions (payroll preparation, invoicing, etc.).

On VSP, data is centralized, enabling correlations to be made between different data. Its SaaS mode provides secure access for all employees, enabling them to work remotely.